A scarcer supply of superyacht buyers, more racing and new build techniques are changing superyacht design, as this year's Monaco Yacht Show illustrates

Nothing can prepare you for the Monaco Yacht Show. It is a temple to superyachting, set in probably the only place in the world that seems custom-made to give it context. Giant motorboats and sailing yachts are crammed immodestly into every part of the harbour, huge and glistening, perfectly prepared and, more often than not, set out with champagne glasses, rolled up towels and come-hither sun loungers.

This is the only boat show in the world where the quaysides are carpeted. Estimated by square metres of linen, number of powder blue Bentleys or average size of women’s sunglasses, the wealth quotient is breathtaking.

You mightn’t realise it on first impression, but the impact of the financial crisis is still very much being felt in superyacht design and build, and in some interesting ways you might not imagine.

It has placed a premium on inventiveness. Where there are fewer people who want to do things bigger, sleeker or faster than before, genius flourishes and this super-scaled area of the marine industry draws some of the cleverest minds in the business.

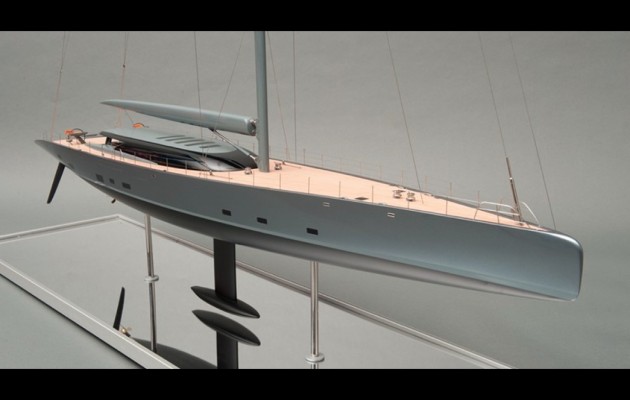

To take one example, the world’s biggest sailing ketch, a new 85m Bill Tripp design, has just finished her very first sea trials. Setting sail on two 90m masts, some of the largest carbon spars ever built, is the culmination of intricate teamwork between designer, mastmaker and sailmakers. One little statistic dropped by Southern Spars today summed up the gargantuan technical challenges: the carbon V1 shroud is engineered to a breaking load of 915 tonnes.

These are the kind of impossible-seeming challenges that keep this business infused with fresh ideas.

A changing market

But bigger designs have become scarcer since ‘the crisis’, and the type of supersailing yacht that is in demand is changing as the market – particularly the brokerage market – has reshaped.

Sailing superyachts are a slim minority of superyachts as a whole – less than ten per cent of new builds – and the boom of the mid- to late- 2000s is long gone. Some say it is cyclical; the less optimistic murmur it may never return. But there are signs that the sailing superyacht market is beginning to gather pace, though concentrated on different size range and type than before 2008.

The greatest area of activity seems to be in the 30-35m size, with particular interest in carbon composite builds. This has been fostered by the growth of superyacht regattas, once just a bit of fun for a few owners, but now quite seriously competitive.

Designer Ed Dubois, who is this year celebrating 40 years in yacht design, says; “Regattas have revolutionised superyacht design in 10-15 years. I remember there were four boats in the St Barths Bucket in 2000 and one went the wrong way round the island. Now there are 36-38 boats.”

Dubois has a 58m aluminium performance racer in built at Royal Huisman in the Netherlands and expects to start next year on a 35m composite racer-cruiser with a huge fold out stern platform, or ‘beach club area’.

Two carbon composite performance designs by Malcolm McKeon are in build, a 33m and a 32.5m, and a 38m carbon design by Philippe Briand is building at Perini Navi. Then there are semi-custom (or semi-production) builds, a Swan 115 launched here in Monaco and three more in build, a Frers 110 underway at YDL in New Zealand, a Wally 110 building in Italy, plus a Wally Cento 4, a Baltic 130 in build and plans for the new Oyster 118.

Most or all of these will be heading for the race course, as part of the owners’ plans.

“I think in the last five years the trend has been to mid-sized composite yachts that can be truly performance orientated. Above that size you need more crew and a lot of owners don’t feel comfortable with an army of staff,” says Nigel Ingram of MCM Yacht Management. “At this size the comfort is super, the connection with the sea is great and the racing is a lot of fun.”

‘People are downsizing’

Designer Philippe Briand has also seen the change. “We believe the centre of the market that was 45-50m has become centred on the 35m range. The bigger size has gone very quiet so we are concentrating on smaller [superyachts]. Basically, people are downsizing.

“It’s a matter of budget, and for a given length the costs at this size have inflated because building in carbon is more expensive, and with lifting keels and other features there is more complexity. For the same budget as a 45m was, you’re now getting a yacht of 30-35m, but it has less crew, is easier to manoeuvre and easier to extract the potential.

“Now 90 per cent of the clients we see are coming to us looking for a composite boat. It has followed 20 years late [compared with race yacht design], but it has happened. But building in composite above 40m is still a big challenge.”

This has in turn meant that yards specialising in carbon composite builds, such as Swan, Baltic and Green Marine (Vitters), have gained a bigger share of the market, and other shipyards are racing to provide capability.

Ed Dubois points to several factors that have been reshaping the supersailing business. He agrees the 40-55m aluminium build market has slowed up, and believes that the reason is “those boats have come down in price.”

When demand exceeded build capacity 8-10 years ago, it created a bubble: a new boat could be worth more than it cost to build. Now, the opposite is true, and the industry and buyers are both taking time to readjust, he suggests.

“Now a boat will cost more to build than it’s worth – that’s a plain fact,” says Dubois. “People have to get into a new mindset and I think the industry is guilty of not being blunt about this. We have got to say: ‘You’re enjoyment is going to cost this.’ [A superyacht] will cost 7.5% of its capital value to run per year and will drop 30% its value when you come to sell.

“We need to say: ‘It’s beautiful being in touch with the sea and nature, you can take your friends along or not, take your family along or not, and you have total independence. It’s a fantastic luxury and it’s going to cost you.”

Faster build times

One hurdle for new buyers that may fall in the next years, he believes, is the long build time for composite superyachts. Right now, a typical timeline to launch is around two years. It can frustrate an owner’s gratification. But builders are looking at ways of improving build efficiencies to compress this time by as much as half.

A decreased demand all round has meant designers have had to compete to become more inventive, and produce interesting and useful new ideas and features. Consequently, supersailing yacht design is at a high point of creativity.

“Innovation in sailing has been a constant evolution thanks to racing, which pushes it hard,” says Philippe Briand. “In motor yachts there was very little evolution until 2010 because there had been no major changes in naval architecture since the 1970s. Then came the idea of efficiency and better hull lines.

“In sailing it is continuing. If we talk about evolution in racing we are looking at appendages and boats like the Open class, IMOCA and Comanche. This is hard to apply, but it is starting to evolve and carbon fibre is the first step.

“You never know what’s round the corner,” says Dubois. “People come in and give you a project, like the 125-footer in 1985 that started it all off for me.”